Calendar Spread Calculator – The basic rule of thumb is that you buy into a calendar spread where the break even point is no more than a 10 percent difference. That is, the long-term premium is no more than 10 percent higher . Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati .

Calendar Spread Calculator

Source : www.fidelity.com

Calendar Put Spread Calculator

Source : www.optionistics.com

Calendar Spreads: How to Trade the Calm Before the Storm luckbox

Source : luckboxmagazine.com

Calendar Call Spread Calculator

Source : www.optionistics.com

Options Profit Calculator & Builder Tutorial | OptionStrat

Source : optionstrat.com

Diagonal/calendar Spread Trade Journal Profit Calculator excel

Source : www.pinterest.com

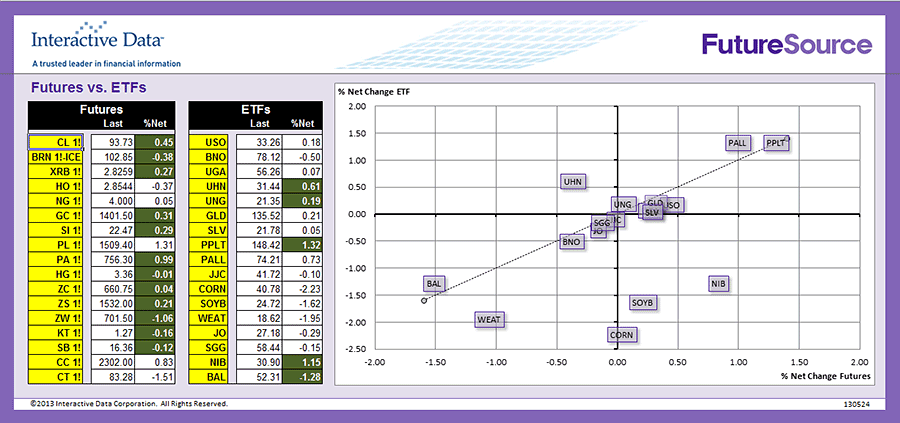

FutureSource RTD Templates

Source : download.esignal.com

Trading Guide on Calendar Call Spread | AALAP

Source : www.myaalap.com

How Reverse Calendar Spreads Work FasterCapital

Source : fastercapital.com

Diagonal/calendar Spread Trade Journal Profit Calculator excel

Source : www.etsy.com

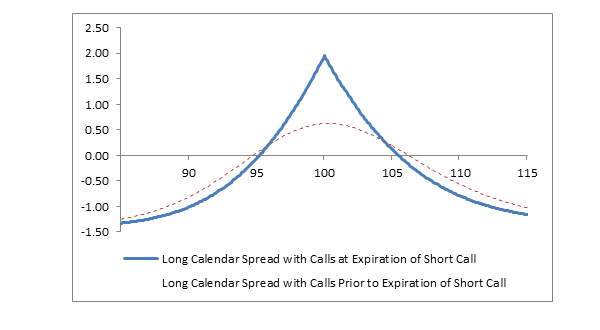

Calendar Spread Calculator Long Calendar Spread with Calls Fidelity: As the first step in the Calendar spread, you must calculate the fair value of the current month’s contract. In the second step, you can calculate the fair value of the mid-month or the far-month . The long put calendar spread is a strategy designed to profit It’s also possible to collect smaller profits, though you can’t calculate your breakeven until after you’ve entered the spread. .